Cardston, Alberta--(Newsfile Corp. - September 6, 2024) - American Creek Resources Ltd. (TSXV: AMK) (OTCQB: ACKRF) (the "Company" or "American Creek") is pleased to announce that it has entered into a definitive arrangement agreement dated September 5, 2024 (the "Arrangement Agreement") with Cunningham Mining Ltd. ("CML") pursuant to which CML has agreed to acquire all of the issued and outstanding common shares of American Creek (the "Shares") at a price of $0.43 per Share (the "Consideration"), in an arm's-length, all-cash transaction valued at approximately $207 million on a fully diluted basis (the "Transaction"). The Transaction will be completed by way of a statutory plan of arrangement under the Business Corporations Act (British Columbia) (the "BCBCA").

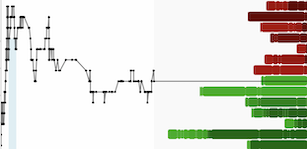

The Consideration represents a 274% premium to the $0.115 closing price of the Shares on the TSX Venture Exchange (the "TSXV") on June 5, 2024, being the last trading prior to the date that American Creek and CML entered into the previously announced non-binding letter of intent (the "LOI") for the Transaction, which LOI has now been superseded by the Arrangement Agreement. In addition, the Consideration represents a 153% premium to the closing price of Shares on the TSXV on September 4, 2024 and a 155% premium based on American Creek's 30-trading day volume weighted average price ("VWAP") on the TSXV for the period ending September 4, 2024. Holders of outstanding options and warrants to purchase shares of American Creek will receive a cash payment for the "in-the-money" value, if any, in respect of all vested options and warrants of American Creek. The Company announced on August 6, 2024, that at that time it had received confirmation that CML has entered into a token subscription facility of up to US$153M for a 36-month term following a centralized exchange listing of the Cunningham Mining Token, the funds from which are expected to be used to fund CML's financial obligations under the Arrangement Agreement.

Ryan Cunningham, President of CML, stated: "We are very excited to enter into this agreement to acquire American Creek. The indirect acquisition in the Treaty Creek Property complements our existing portfolio of assets in the Golden Triangle. We look forward to the positive impact that the addition of the Treaty Creek Property will have on our upcoming NGTGOLD Token."

Darren Blaney, CEO of American Creek, stated: "We are pleased and excited to enter into this agreement with Cunningham Mining. I commend the team at Cunningham for recognizing the value of American Creek's 20% carried interest in the Treaty Creek Project, in particular the expanding Goldstorm gold and copper deposit, and the mineral potential of the Treaty Creek Project as a whole.

We are also very pleased to have Eric Sprott's full support and endorsement of this transaction with Cunningham. We express our sincere appreciation for being able to associate with the Sprott team and for their significant and unwavering support through the years."

Transaction Highlights

All-cash offer providing American Creek shareholders with an immediate and attractive premium.

All directors and officers of American Creek and American Creek's largest shareholder (being a company controlled by Eric Sprott), which collectively hold an aggregate number of Shares that represent approximately 15.5% of the currently outstanding Shares, have each entered into customary support and voting agreements (collectively, the "Voting Support Agreements") with CML pursuant to which they have agreed, among other things, to vote all of their Shares (including any Shares issued upon the exercise of any securities convertible, exercisable or exchangeable into Shares) in favour of the Transaction.

Board of Directors Recommendation

The board of directors of American Creek (the "Board"), having received a unanimous recommendation from a special committee comprised of a majority of independent directors of American Creek (the "Special Committee") and after receiving outside legal and financial advice, has unanimously determined that the Transaction is in the best interests of American Creek and is fair to the shareholders of American Creek (the "Shareholders") and other securityholders (warrantholders and optionholders) (the "Other Securityholders") and unanimously recommends that Shareholders vote in favour of the Transaction. In making their respective determinations, the Special Committee and the Board considered, among other factors, the fairness opinion of RwE Growth Partners, Inc. The fairness opinion concluded that, as of September 2, 2024, subject to the assumptions, limitations and qualifications contained therein, the Consideration to be received by the Shareholders and the Other Securityholders pursuant to the Transaction is fair, from a financial point of view, to such Shareholders and Other Securityholders. A copy of the fairness opinion will be included in the management information circular of the Company (the "Information Circular") to be mailed to the Shareholders in connection with the special meeting of Shareholders (the "Meeting") to be called to approve the Transaction, which Meeting is expected to be scheduled to take place in late October or early November, 2024.

Transaction Details

The Transaction will be implemented by way of a statutory plan of arrangement under Division 5 of Part 9 of the BCBCA (the "Plan of Arrangement"). Completion of the Transaction is subject to customary conditions, including, among others, court approval and regulatory approvals (including the approval of the TSXV), and will, among other things, require the approval of (i) at least two‐thirds of the votes cast by the Shareholders present in person or represented by proxy at the Meeting, and (ii) a simple majority of the votes cast by Shareholders on a resolution approving the Arrangement, excluding for this purpose the votes attached to the Shares held by persons required to be excluded for purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions.

The Arrangement Agreement provides for customary deal protection provisions, including non-solicitation covenants of American Creek, "fiduciary out" provisions in favour of American Creek and "right-to-match superior proposals" in provisions in favour of CML. The Arrangement Agreement provides for a termination fee of $6,286,125 payable by American Creek if it accepts a superior proposal and in certain specified circumstances. In addition, on or before September 30, 2024, CML will pay American Creek a cash signing fee of $300,000, which funds will be used for working capital purposes in the ordinary course of business (including reasonable expenses incurred by American Creek related to the Transaction). 50% of the signing fee (i.e. $150,000) will be repayable by American Creek to CML in equal monthly installments of $10,000 in the event that the required Shareholder approval is not obtained at the Meeting or the Transaction is terminated due to a non-curable breach of the Arrangement Agreement by American Creek.

Each of American Creek and CML have made customary representations and warranties and covenants in the Arrangement Agreement, including covenants regarding the conduct of American Creek's business prior to the closing of the Transaction.

Pursuant to the terms of the Arrangement Agreement, each outstanding option to purchase common shares in the capital of American Creek (each, an " Option") immediately prior to the effective time of the Arrangement will be, and will be deemed to be, unconditionally vested and exercisable and will be deemed to be assigned and transferred by such holder to American Creek in exchange for a cash payment from American Creek equal to the Option in-the-money amount. Each such Option will immediately be cancelled, and the holder will cease to be a holder of such Option.

Each share purchase warrant of the Company (each, a "Warrant") issued and outstanding immediately prior to the effective time of the Arrangement will be deemed to be assigned and transferred by such holder to American Creek in exchange for a cash payment from American Creek equal to the Warrant in-the-money amount. Each such Warrant will immediately be cancelled, and the holder will cease to be a holder of such Warrant.

Subject to the satisfaction of all conditions to closing set out in the Arrangement Agreement, it is anticipated that the Transaction will be completed in late November or early December 2024. Upon closing of the Transaction, it is expected that the Shares will be delisted from the TSXV and that American Creek will cease to be a reporting issuer under applicable Canadian securities laws.

The foregoing summary is qualified in its entirety by the provisions of the respective documents. Copies of the fairness opinion, and a description of the various factors considered by the Special Committee and the Board in their respective determination to approve the Transaction, as well as other relevant background information, will be included in the Information Circular to be sent to the Shareholders in advance of the Meeting. Copies of the Information Circular, the Arrangement Agreement, the Plan of Arrangement, the Voting Support Agreements and certain related documents will be filed with the applicable Canadian securities regulators and will be available in due course on SEDAR+ (www.sedarplus.ca) under American Creek's issuer profile.

About CML

Cunningham Mining Ltd. (www.cunninghammining.com) has successfully completed the acquisition of the placer claims known as the 'Nugget Trap Placer Mine" in the British Columbia Mineral Title registry, covering 573.7 acres, along with the accompanying permits and authorizations. The property is situated within the Skeena Mining Division of British Columbia, Canada, in the area known as BC's Golden Triangle. The company intends to digitize this and future in ground deposits as well as operating mines and claims through the issuance of its Digital Asset Token, NGTGOLD Token (nuggettrap.com). Its registered office is located at 10026 Pacific Centre, 25th FL, Vancouver, BC, V7Y 1B3.

About American Creek and the Treaty Creek Project

American Creek is a proud partner in the Treaty Creek Project, a joint venture with Tudor Gold Corp. located in BC's prolific "Golden Triangle".

American Creek holds a fully carried 20% interest in the Treaty Creek Project until a production notice is given, meaning that no exploration or development costs are incurred by American Creek until such time as a production notice has been issued. American Creek shareholders have a unique opportunity to avoid the dilutive effects of exploration while maintaining their full 20% exposure to one of the world's most exciting mega deposits.

The Company also holds the Austruck-Bonanza gold property located near Kamloops, BC.

ON BEHALF OF AMERICAN CREEK RESOURCES LTD.

"Darren Blaney"

Darren Blaney, President & CEO

For further information please contact Kelvin Burton at:

Phone: (403)752-4040 or Email: info@americancreek.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) which reflect American Creek's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this news release include statements regarding the proposed acquisition by CML of all of the Shares of American Creek and the terms thereof, CML's ability to finance the Transaction under its token subscription facility, the anticipated date of the Meeting, the anticipated filing of materials on SEDAR+, the expected date of completion of the Transaction, the expectation that the Shares will be delisted from the TSX Venture Exchange and that American Creek will cease to be a reporting issuer under applicable Canadian securities laws and other statements that are not historical fact. The forward-looking statements in this news release are based on a number of key expectations and assumptions made by American Creek including, without limitation: the Transaction will be completed on the terms currently contemplated, the Transaction will be completed in accordance with the timing currently expected, all conditions to the completion of the Transaction will be satisfied or waived and the Arrangement Agreement will not be terminated prior to the completion of the Transaction, and assumptions and expectations related to premiums to the trading price of the Shares and returns to the Shareholders. Although the forward-looking statements contained in this news release are based on what American Creek's management believes to be reasonable assumptions, American Creek cannot assure investors that actual results will be consistent with such statements.

The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements. Such factors include, among others: the Transaction not being completed in accordance with the terms currently contemplated or the timing currently expected, or at all, expenses incurred by American Creek in connection with the Transaction that must be paid by American Creek in whole or in part regardless of whether or not the Transaction is completed, the conditions to the Transaction not being satisfied by American Creek and CML, currency fluctuations, disruptions or changes in the credit or security markets, results of operations, and general developments, market and industry conditions. Additional factors are identified in American Creek's most recent Management's Discussion and Analysis, which is available on SEDAR+ at www.sedarplus.ca. Readers, therefore, should not place undue reliance on any such forward-looking statements. There can be no assurance that the Transaction will be completed or that it will be completed on the terms and conditions contemplated in this news release. The proposed Transaction could be modified or terminated in accordance with its terms. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, American Creek assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/222461

.jpg)